We are all familiar with many commodities that have a global price tag and the universal market treats instances of them as equivalent, with no regard to who produced them. In the economy, commodities include some types of goods and energy, such as oil, gold, wheat, copper, gas, electricity, etc. In the meantime, wood does not have a specific place. Is wood traded as a commodity? Is there a specific scale for the price of wood or lumber? How can timber be priced as a regional or global commodity? Generally, what is the Global Wood Price Scale? In this article, we will try to answer these and similar questions.

Is Wood a Commodity?

First, let’s define what is called a “commodity”. Basically, goods and raw inputs which are the same as each other in almost any part of the world and cannot be distinguished can be called as commodities. Copper is copper everywhere in the world and no one can tell from which mine this copper was extracted. Or, for example, it is not possible to distinguish from the taste of corn in which country this corn was planted. In this sense, wood can also be considered a commodity. But in fact, wood has a very wide range. What standard for the global price can be imagined for it?

Standardization of Wood for Trade

A ton of copper is a ton of copper everywhere in the world! A kilogram of wheat is a kilogram of wheat everywhere in the world. A barrel of oil is a barrel of oil everywhere in the world and it has a specific volume and also a specific price. But when we talk about wood, how can we define a fixed scale to measure it?

Considering a global price for wood requires standardization of the product. What is traded in commodity exchanges is “timber”. Timber, also known as lumber in USA and Canada, is the wood that has been processed into beams and planks. Finished lumber in standard sizes is mostly used in the construction industry. It is interesting to know that 80% of timber comes from softwoods such as pine, cedar, and spruce.

After this introduction, let’s get to the point. What is the market for buying and selling timber that can be considered as a scale for speculating the price of timber?

Chicago Mercantile Exchange – Lumber Futures

The United States has the largest economy in the world. The gross domestic product of this country is 24.116 trillion dollars (as of now – 2022), which alone includes a quarter of the entire world economy. Therefore, it is natural that global commodity prices are affected by the United States economy.

Although in different parts of the world the price is determined based on supply and demand, the timber price trend in the USA can be a scale for predicting timber prices in other parts of the world.

Lichtenberg Wood Burning eBook

Download Lichtenberg Wood Burning eBook

One of the modern techniques for creating wooden artwork is called Lichtenberg wood Burning. In this eBook, we are going to introduce this newfound art to you.

This technique is known with some different names such as Lichtenberg wood burning, fractal wood burning, and electricity wood art.

This technique should not be confused with wood burning art or pyrography. The art of pyrography on wood is the art of creating motifs and designs by burning with hot metal tools on objects such as wooden surfaces.

Lichtenberg burning is a wood-burning technique for creating designs with electricity.

This eBook is a comprehensive guide on Lichtenberg Wood Burning. All you need to know for Lichtenberg Wood Burning is here.

This is a limited-time offer, order now to get access to the future eBook releases.

The Chicago Mercantile Exchange became the first exchange to offer lumber futures in 1969. CME lumber futures are called ‘Random Length Lumber Futures’ because no two types of lumber will be identical due to natural differences such as knots, the slope of grain, and natural wear.

The contracts are standardized as much as possible in terms of dimensions, grade, and moisture content. Also, the size of the contracts is clearly defined.

All CME lumber futures trade in Western Spruce-Pine-Fir species, although Hem-Fir, Engelmann Spruce, and Lodgepole Pine can also be included. The mills have to be located in:

- Oregon

- Washington

- Idaho

- Wyoming

- Montana

- Nevada

- California

- British Columbia (Canada)

- Alberta (Canada)

Where Can You Find Lumber Commodity Live Prices?

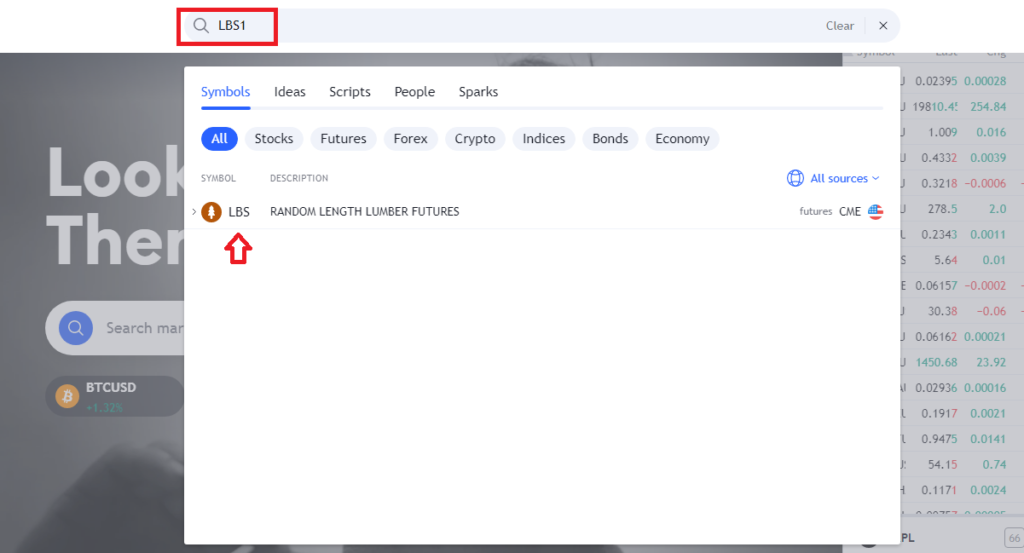

Random Length Lumber Futures Contracts (LB) trade in random-length 2 x 4s, from 8-20 feet its symbol on tradingview.com is LBS1. So to find live lumber prices, go to the TradingView site and search for the symbol LBS1 in the search field (Shown in the image below).

To forcast the price of wood for 2023, refer to the following article:

Lumber Price Forecast for 2023

Conclusion

Wood trade in the form of “timber” is of interest as a commodity. As you can see, in order to trade wood as a commodity, it is necessary to define a series of standards for it, which are much more complicated than other commodities such as copper, gold, and oil. Lumber futures contracts are offered on the commodity exchanges such as the CME. Which can be an inspiration for wood traders worldwide. At the regional level, the price of lumber is completely dependent on supply and demand and may not have any special correlation with LB.

For more information on how to trade lumber, see How to trade lumber futures.