The price of lumber has fluctuated a lot in the last few years, and many lumber traders want to know the outlook of the lumber market. Many analysts believe that background events such as the outbreak of Covid-19 and the war in Ukraine have caused these fluctuations. Chicago lumber futures have been on a downward trend in the second half of 2022 and are now at their lowest level in 2022 (down almost 70% since its March peak). In this article, we are going to look more closely at the fundamental factors affecting the price of lumber and then examine the lumber market outlook.

What Are the Most Important Fundamental Factors Affecting the Market of Lumber?

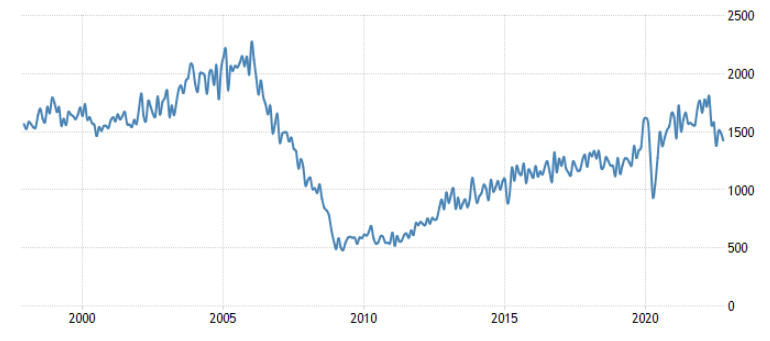

In the picture below, you can see the lumber price chart on the Chicago Mercantile Exchange (lumber futures). The price has formed two peaks (the first in May 2021 and the second in February 2022). As you can see, the price has fluctuated greatly in the last few years. This shows that the market is abnormal. But what is actually the cause of these fluctuations?

Before we want to comment on the future of the lumber market, we must first mention the fundamental factors affecting the price of lumber. First, we must check how supply and demand change in this industry.

Demand: Housing

Lumber is wood that has been processed into dimensional lumber, including beams and planks. Lumber is mainly used for construction framing, flooring, wall panels, and window frames. According to official statistics, on the demand side, housing continues to be a significant driver for lumber. So the most important demand for lumber is in the construction industry and real estate.

If the activity of this industry decreases for any reason, the demand for lumber will decrease and then the price of lumber will decrease. But what causes the reduction of real estate activity?

Increase in Interest Rates and Weakens Sentiments Among Home Builders

Increase in interest rates and the Federal Reserve’s aggressive tightening cycle and increase in 30-year mortgage rates, leads to slower house construction and weakens sentiments among home builders.

But what causes an increase in interest rates? It can be summed up in one word: inflation. Inflation is currently at a 40-year high, prompting the Federal Reserve to raise interest rates from zero to 4 percent.

Lichtenberg Wood Burning eBook

Download Lichtenberg Wood Burning eBook

One of the modern techniques for creating wooden artwork is called Lichtenberg wood Burning. In this eBook, we are going to introduce this newfound art to you.

This technique is known with some different names such as Lichtenberg wood burning, fractal wood burning, and electricity wood art.

This technique should not be confused with wood burning art or pyrography. The art of pyrography on wood is the art of creating motifs and designs by burning with hot metal tools on objects such as wooden surfaces.

Lichtenberg burning is a wood-burning technique for creating designs with electricity.

This eBook is a comprehensive guide on Lichtenberg Wood Burning. All you need to know for Lichtenberg Wood Burning is here.

This is a limited-time offer, order now to get access to the future eBook releases.

Now you have to ask what causes inflation. The Covid-19 pandemic and the temporary lack of resources, labor and the delay in the transportation of goods, which are the consequences of the recession caused by the Coronavirus epidemic, caused the government to print more money to deal with it, and this issue led to an increase in inflation. In fact, the current inflation is still a relic of the Covid-19 virus.

As you have seen, there is a chain of cause and effect that ultimately causes the price of lumber to fluctuate. We will discuss this in more detail later.

Supply: Production

Supply in the market has a direct relationship with the amount of lumber production. Lumber harvest expectations of foresters are dependent on economic efficiency. As prices decline and demand falters, we see sawmills respond with a decrease in production (prominent in high-cost mills).

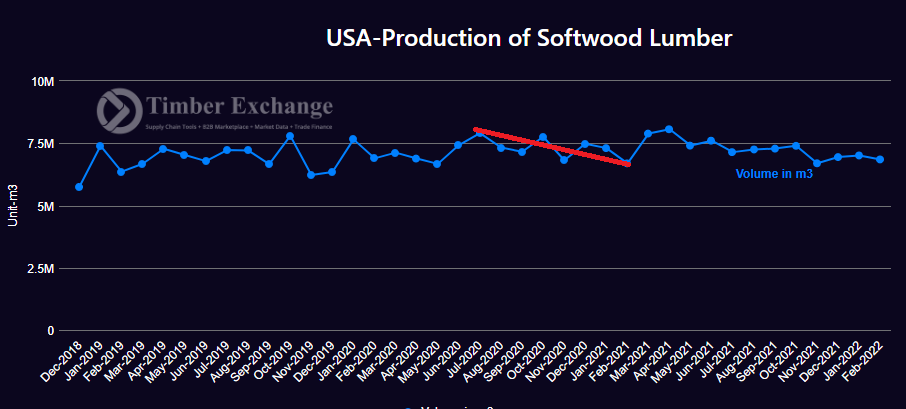

In the picture, you can see the amount of soft lumber production in the United States in recent years. From late 2020 to early 2021, production decreased, the main cause of which was the fear of the spread of Coronavirus (with the assumption that demand will decrease). But the demand did not decrease at that time and we saw the price increased at the beginning of 2021.

Summary of This Section: The Causes of Two Peaks in the Price of Lumber in Recent Years

According to the explanations given above, let us make a summary and clarify the reasons for the creation of two peaks in the price of lumber.

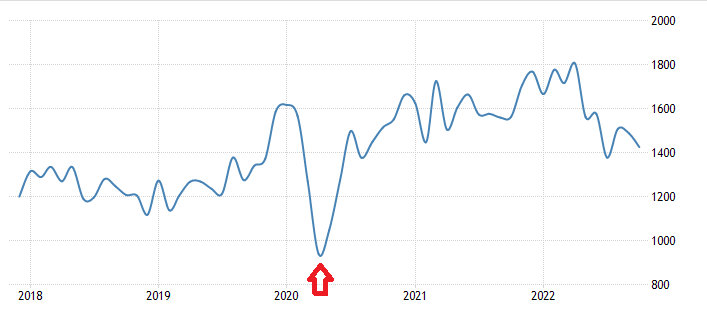

The first confirmed case of the novel coronavirus (COVID-19) in the United States was announced on January 21, 2020. As you can see in the picture below, on this date, the timber market is still calm.

At first, manufacturers reduced production due to the fear of an economic recession caused by the pandemic. This fear was caused by a sharp drop in the Housing Starts indicator (We will explain more about this indicator in the next section). In the picture below, you can see how the desire to build a house decreased at the beginning of 2020. It was a shock. But then the trend was reversed.

Then with the expansionary monetary policies of the Federal Reserve, the demand for lumber intensified, and the desire to repair and build houses increased. As lumber inventory dwindled, this caused prices to skyrocket. This is the story of the first price peak. The first price peak, in fact, was caused by a disconnection between demand and supply.

After that, production increased and supply and demand were balanced and the price returned to its previous position. But recently, things happened that constrain transportation and logistics. This issue, along with inflation and the energy crisis (at the international level), caused the second peak of lumber prices in 2022. After that, the contractionary monetary policy of the Federal Reserve and the significant increase in interest rates, as well as the removal of transportation restrictions, caused the price of lumber to fall again and return to previous levels.

In this way, the story of the second peak is over. Therefore, the reasons for creating two price peaks of lumber in recent years were different.

What Will Be the Lumber Market Outlook?

Now let’s look at the future of the lumber market. According to what was said, the lumber market outlook is highly dependent on the demand and desire to build houses. This issue depends on the policies of the Federal Reserve. In any case, lumber market activists should carefully monitor the desire of housing builders. The indicator of this “sentiment” is the “United States housing starts“.

What is “United States Housing Starts”?

The “United States housing starts” measures the monthly change in the number of new residential buildings that began construction during the reported month. It is an important indicator of the strength in demand for lumber.

In the picture below, you can see the 25-year graph of this indicator. The downward trend of this indicator in the “Great Recession” of 2008 is quite clear. Lumber producers are afraid of the beginning of an economic downturn similar to 2008, and today there are signs based on its occurrence.

Reference: Trading Economic

United States Housing Starts Forecast

Considering the current trend of increasing interest rates to counter inflation, the downward trend of the house indicator is expected to continue. But considering that the United States core consumer price index (CPI) for October was lower than the forecasts, there is hope that the interest rate will increase less in the next meetings of the Federal Reserve. In other words, many analysts believe that a major economic downturn is not coming.

Lumber Market Forecast for 2023

According to what has been said, we can expect to see interest rate growth stop in 2023, and thus the demand will improve. Of course, this will not mean creating a third price peak. The Lumber market is likely to be relatively stable in the coming year and we will see fewer fluctuations (like the trends before the pandemic).

If you are interested, see Lumber Price Forecast for 2023. In that article, we have looked at this issue from the angle of technical analysis.

Long-Term Outlook in the Lumber Market

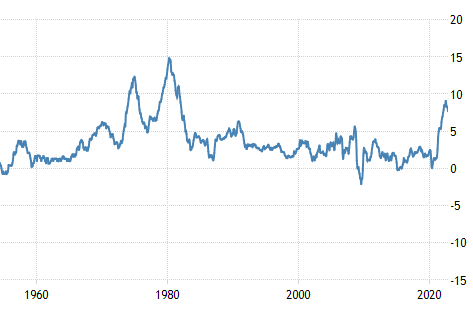

On the one hand, the speed of population growth and the need for housing, and on the other hand, the limited wood resources, which means increasing demand and decreasing supply, push the price up by itself. This issue, along with inflation, will naturally increase the price of lumber in the long-term outlook. In the picture below, you can see the 50-year trend of lumber prices that proves this.

We should not be naive to all these explanations. The global economy is changing rapidly. Technology is advancing rapidly. Social and political issues at the international level along with these issues, can create important changes in the mentioned parameters that our hypothesis will be completely reversed. For example, in the long term, these factors may stop population growth, or a better alternative may be invented as building materials.

In any case, traders must be very smart, and the contents expressed in this article only illuminate a corner of the factors involved in the possible future of the lumber market, and there are still many dark-side points.